TL;DR

- Starknet’s decentralization demands a proof-of-stake (PoS) model that rewards stakers with minted tokens for participating in the network’s governance, security, and maintenance.

- StarkWare’s minting proposal for Starknet is composed of two overarching properties:

- The more tokens staked, the higher the total minting rate.

- The more tokens staked, the lower the staking reward as a percentage of the staked amount.

- Like all significant protocol upgrades, this proposal will need to pass community and governance approval to be incorporated into Starknet.

Intro

Over a year ago, StarkWare proposed a path toward full decentralization of the Starknet network, which also explained how Starknet’s native token, STRK, would play a role in that process. A part of that plan is to transition the operation of the Starknet sequencer and prover to a proof-of-stake (PoS) protocol, whereby anyone can participate in sequencing such that no single party is essential to the continued liveness of the network.

Anyone who holds STRK will be able to participate in staking on Starknet, empowering the community to take part in the network’s governance, security, and overall maintenance.

Every PoS model needs a mechanism for issuing new tokens that both encourages participation in network maintenance and manages inflation expectations. In this post, we propose a specific mechanism to do so on Starknet ahead of its transition to PoS.

Minting guidelines

Loosely based on Ethereum’s monetary policy since it transitioned from proof-of-work (PoW) to proof-of-stake (PoS), the below token-minting proposal for Starknet aims to strike the right balance between two goals:

- Rewarding stakers for their contributions to the network (governance, security, and maintenance). New minting will be partially used to offset the fixed costs of staking on the network for stakers, who may also receive additional rewards from fees.

- Setting inflation expectations for STRK by capping the inflation rate. There are currently 10 billion STRK in existence. If this staking proposal goes into effect, that number will rise, but the inflation rate will be capped at 4% annually (more on this below).

To achieve these goals, the desired minting mechanism would require minting enough STRK to ensure sufficient rewards for stakers, but also to prevent the staking rate from getting so high that too many tokens need to be minted and inflation gets out of control.

That means:

- The more tokens staked, the higher the total minting rate (to ensure sufficient rewards for stakers).

- The more tokens staked, the lower the staking reward (to balance the need for stakers with the need to control inflation). This will let the market regulate the staking rate and ensure sufficient staking.

A minting curve that rewards stakers and controls inflation

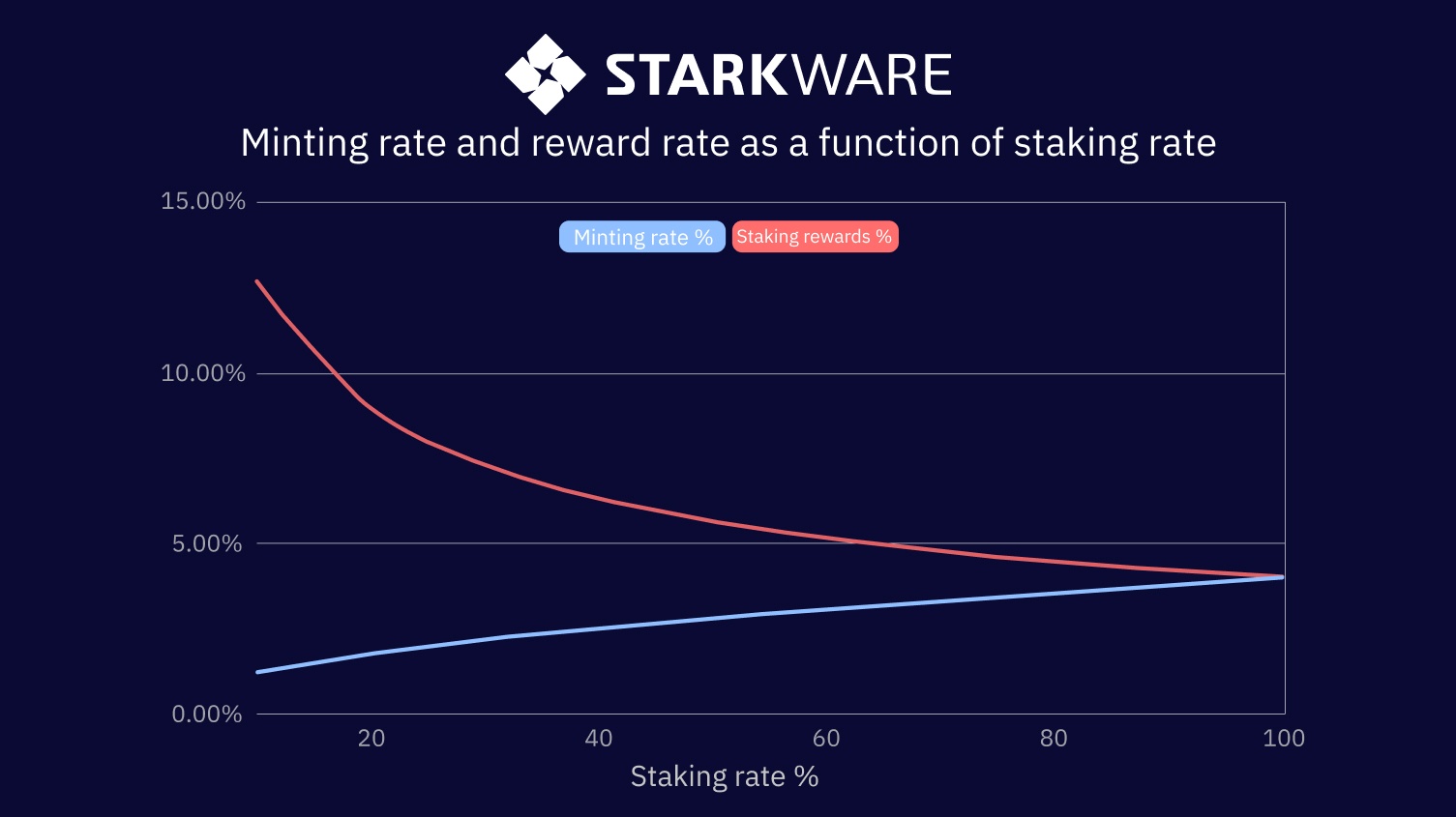

We’ve established that there should be a direct relationship between the staking rate and the total minting rate, and an inverse relationship between the staking rate and the staking rewards allotted to stakers. Adopting Ethereum’s “square root” tradeoff, we propose that the minting rate be proportional to the square root of the staking rate, with added parameters chosen to ensure a 25% staking rate will result in 2% annual minting.

This implies the minting formula: M = 0.4 * √ S , where S is the staking rate in percent of the total supply of tokens and M is the annual minting rate, again in percent of the total supply of tokens. For example, S=25 means that 25%=1/4 of the tokens are staked, in which case the square root is 5 and M=0.4*5=2, meaning the annual minting rate is 2%. The minting formula is shown in the figure below, together with the implied reward rate.

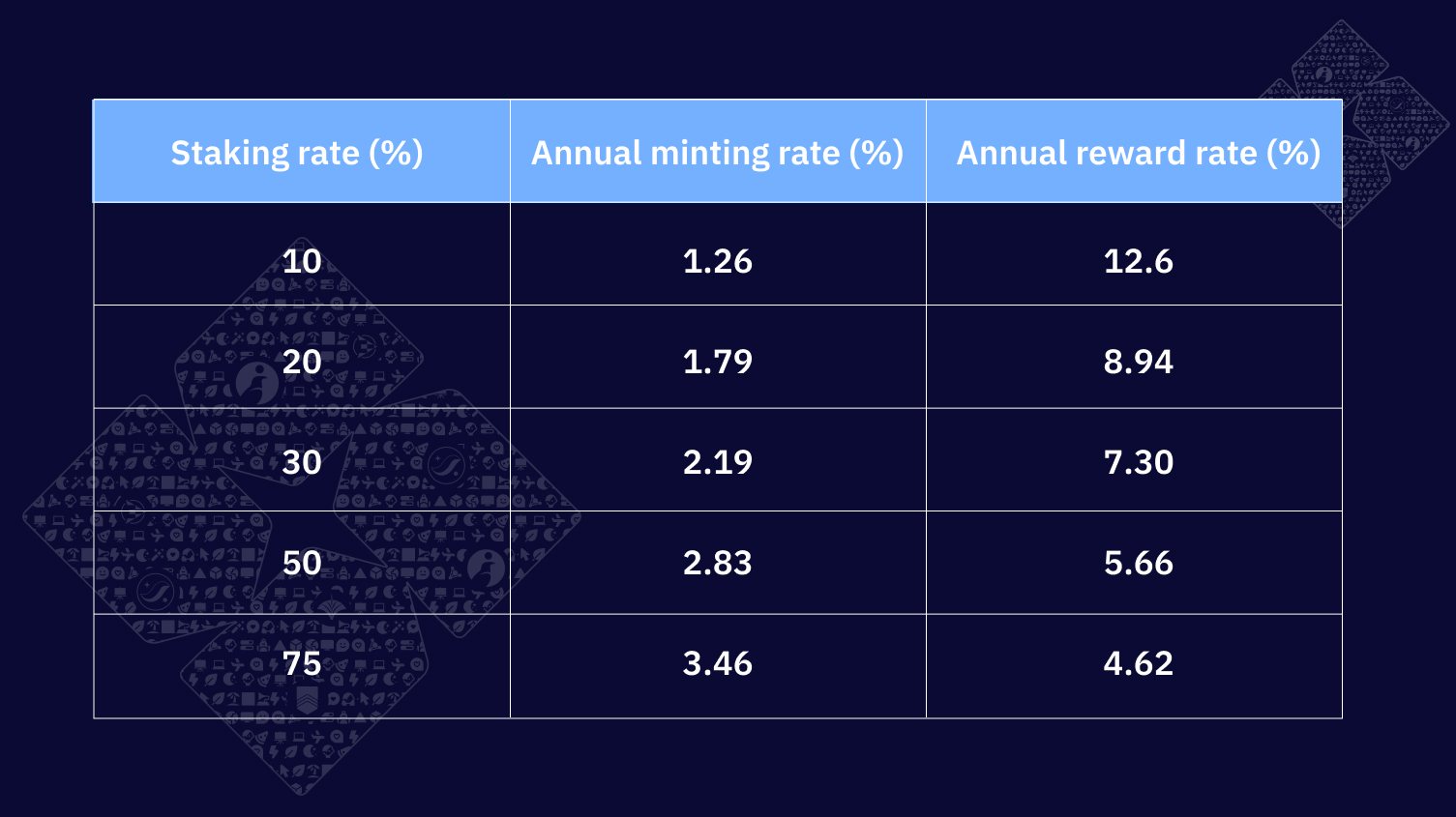

This means the maximum theoretical annual minting rate is 4% (reached if there is 100% staking). Below are a few other examples:

Take the first row above as an example. If the fraction of staked tokens (out of all existing tokens) stays fixed at 10% for a full year, then the overall annual inflation would be approximately 1.26%, i.e., the number of circulating tokens at the end of the year would be approximately 1.0126 times the number of tokens on the first day of that year, and the annual return seen by each staker would be approximately 12.6% (measured in STRK). Minor details and the timing of the calculation of the staking rate and the rewards are left to the future SNIP (Starknet Improvement Proposal).

It’s important to note that such a plan could only go into effect after Starknet’s native token, STRK, becomes transferable (which will happen when the Starknet Provisions Program is initiated). Furthermore, minting new tokens requires that staking is available and permissionless as part of Starknet’s decentralization process. Finally, any token-minting proposal would have to be accepted by the community in a governance vote.

Summary

As Starknet continues on its journey toward decentralization, one of the next stops is the transition to a PoS model. The network will require a mechanism for minting new tokens that rewards stakers and encourages participation in network maintenance but also sets expectations for inflation.

We look forward to a full SNIP outlining in more detail this token-minting proposal for Starknet, as well as community input.

Follow the Starknet Community Forum for updates.

Check out Part 3 of our decentralization proposal for more information about the Starknet Token design.